E-file Form 7004, A Simple Tax Extension Filing Solution for Business Owners

Efile-7004.com is a trusted IRS Authorized e-file provider to E-file Form 7004 that offers secured and simple filing solutions for tax extension Form 7004.

Our Software walks you through a step by step filing process with clear instructions to apply an extension for business tax returns and provides you with a simple way to pay your balance dues along with your extension Forms. To request an business income tax extension, you don’t have to provide any explanation. We also support filing of tax Extension Forms 4868, 8868, & 8809.

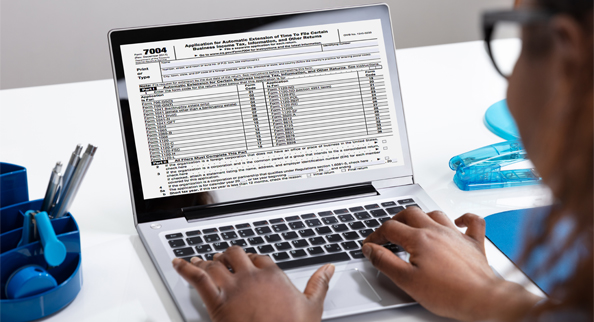

E-file your Form 7004 with our Cloud Based Software

IRS Authorized

Efile-7004.com is an IRS-authorized, e-file provider for filing your tax extension forms securely.

Easy to Use

With our easy interface and step-by-step process, e-filing your extension form is made simple, and it is done within a few minutes.

Instant Notification

Our Software provides you with an instant email notification regarding the status of the IRS acceptance. You can also check it from your dashboard, or even subscribe to our text or fax alerts.

Safe & Secure

Efile-7004.com follows latest secured encryption protocols to ensure that your data is kept secured within your account.

File From Any Device

Our cloud-based software helps you to file Form 7004 conveniently from any device at any time.

Re-transmit Rejected Returns for Free

If your Extension is rejected by the IRS for any reason, we will provide you the reason for rejection and help you to fix the errors. We allow you to re-transmit it for FREE.

Our U.S. Based customer support will assist you with any questions regarding your tax extension e-filing process.

Form 7004 E-Filing Requirements

To E-file Form 7004, you should have these following information

- Business Name, EIN, and Address

- Type of Forms for which the extension is filed

- Tax Year details

- Tax Payment & Balance Due Details

Note: Be sure the information you are providing at the time of filing matches with the details on the IRS Record. You can verify your information with the IRS by calling 1-800-829-4933.

Click here to know detailed information of Form 7004 Instructions.

You need the above-mentioned details to file 7004 online in minutes

What is Form 7004 and why do S-corporations and Partnerships need to file it?

Form 7004 is a Business Tax Extension Form that S - Corps and partnerships can file to request an automatic extension of up to 6 months from the IRS to file their income tax returns.

If you have an S-corporation or a Partnership business and it is due by March 15, 2024, and if there is any difficulty in filing your business tax return then you can E-File Form 7004 and request an extension for up to 6 months.

Form 7004 is an automatic extension and IRS doesn’t require any explanation for it. Filing Form 7004 will provide you with an extension of up to 6 months to file your business tax returns with the IRS.

Steps to E-File 7004 Form with our Software

Efile-7004.com is a cloud-based application that offers tax experts and business owners a solution to e-file business tax extensions with the IRS for the lowest price.

Here's how it works:

Tax Extension Form 7004 Due Date Calculator

E-file your Business Income Tax Extension Form 7004 Now

What is IRS Form 7004?

IRS Form 7004 is used to request an automatic extension of time to file certain business income tax, information, and other returns for up to 6 months.

The extension gets granted automatically if you properly complete Form 7004 with the IRS. Make a proper estimation of owed taxes (if applicable), and file Form 7004 by the due date along with any tax that is due.

Submitting a business tax extension allows more time to organize all the necessary paperwork, and it also gives you more time to make sure that you get the most out of your credits or refunds.

When is the deadline to file IRS Form 7004?

Form 7004 must be filed before the 2023 business tax extension deadline to avoid unwanted penalties from the IRS. The deadlines are as follows,

- For business tax forms 1120-S, 1065 & few more forms, Form 7004 is due by March 15, 2024.

- For form 1120, 1041 & other business tax forms, Form 7004 are due by April 15, 2024.

E-file 7004 Now before the deadline & Avoid Late Filing Penalties.